Investment property is a term that is often used in the world of real estate. Simply put, it refers to a property that is purchased with the intention of generating income or profit through rental income, appreciation, or both. If you have been considering buying an investment property, there are certain signs that indicate you may be ready to take this step.

Perhaps you've been saving up for a down payment and have done extensive research on what makes a good investment property. Or maybe you already own several properties and are looking to expand your portfolio. Whatever the case may be, being prepared and informed can make all the difference when it comes to buying an investment property. That's why we've created this guide to help you understand the basics and give you some insight into what you need to know before taking the plunge. By following our advice, you could start making money from your investment property as early as March 31st, 2023!

Here's an interesting read: Property Manager

Investment Property Definition

Investment property is a real estate purchased with the intention of generating income, either through rental income or appreciation investment properties. These properties are typically purchased by a single investor, and can vary from commercial buildings to residential homes. They are an attractive investment opportunity as they offer the potential for long-term growth and passive income. Whether you're looking to diversify your investment portfolio or generate additional income streams, investment property can be a smart financial move.

A unique perspective: Property Lines

1. See What You Qualify For

Looking to invest in a property? Rocket Mortgage has made it easier than ever to see what you qualify for. Simply enter your home description and credit profile on their sign-in page and the options will automatically pop up. If you're a first-time homebuyer, congratulations! The home loan process online is quick and easy. Rocket Mortgage respects your privacy with their telephone consumer protection act and resolve claims related policies, so feel free to input your contact information and explore your investment options today.

Unlocking the Door to Your Dream Investment Property

Investment property depends on the individual investor you'll become. You may choose a single-family home or a multifamily home, or even a large complex or commercial property. Obtaining financing isn't like purchasing a personal residence. Fewer lenders offer mortgages for investment properties and qualifying is much harder. You'll need to meet standard mortgage requirements, including good credit score, cash reserves, stable income, and debt-to-income ratio (DTI).

To qualify, you'll need W2s pay stubs and tax returns. Keep in mind that many banks don't offer financing for investment properties; therefore, you'll have to shop around to find lenders who do. Some banks also require higher down payments for investment properties compared to personal residences.

Investment properties can be an excellent way to build wealth over time if done correctly. Owning an investment property provides additional passive income streams that can help you achieve your financial goals faster than relying solely on your salary. However, it's vital to do your research and understand what you're getting into before purchasing an investment property.

How Investing Affects You: A Guide for Individual Investors

Investment property is a popular investment among individual investors, with real estate consistently ranking as one of the most trusted and reliable forms of long-term investment. In fact, a 2021 Gallup poll found that real estate was the preferred long-term investment for 35% of Americans, with stocks lagging behind at just 21%. Adding investment properties to your portfolio of real estate can be an excellent way to diversify your money investments.

Investment property can take many forms, from buying and renting out single-family homes or multi-unit apartment buildings to investing in real estate investment trusts (REITs) or participating in real estate crowdsourcing platforms. These options are worth exploring if you're looking for a hands-off approach to investing in real estate or want to add real estate investments to your portfolio without the hassle of managing physical properties.

No matter which route you choose, it's important to remember that investment property is a long-term investment. While there may be fluctuations in the market over the short term, history has shown us that over time, real estate tends to appreciate in value. By taking a careful and thoughtful approach to investing in investment properties, you can position yourself for lasting financial success.

If this caught your attention, see: Tax Lien Investing

1. Note

Note: If you're interested in investing in property, it's important to stay up-to-date with the latest data and trends. Subscribe to a balances newsletter like Daily Insights Analysis or Michigan Qualifying to receive financial tips delivered straight to your inbox. Keep an eye on the American Enterprise Institute Home Appreciation Index and the monthly supply of homes for sale, and take note of Gallup Americans' expectations for home price rises – divided they may be. By clicking 'accept', you can enhance site navigation and analyze site usage for better marketing efforts.

Discover the Qualities of an Ideal Investment Property

Investment property is a great way to make money, but finding the right one can be challenging. Emil Shour, Growth Marketing Manager at a real estate investment marketplace purchased several properties with potential cash flow. One important criterion for choosing the right investment property is profit potential. Using a formula called total monthly rent divided by total purchase price plus needed repairs, you can determine if a property is worth buying.

Kathy Fettke, co-founder of RealWealth Network and author of Retire Rich with Rentals recommends looking at things like affordability appreciation, job growth, population growth, and infrastructure growth to ensure that the value of your property increases over time. Additionally, rental properties Fettke suggests should have healthy cash flow to cover expenses such as transportation costs and property utilities. Residential, commercial, and industrial investment properties include single-family homes, multifamily homes, condos, townhouses, commercial real estate properties like office buildings and strip malls; restaurants; industrial real estate properties consist of warehouses and manufacturing buildings.

When investing in property it's important to have good credit score and cash reserves. The payment requirement for a multifamily unit investment property may be higher than for a single-property because mortgage lenders view these as riskier loans depending on your credit score. An investment property loan can generate rental income used to pay off the mortgage while also providing tax deductions including mortgage interest depreciation and property taxes. On a similar note when choosing an investment property it is important to remember that massive expenses may arise so investors should always keep some extra funds aside just in case something happens!

Frequently Asked Questions

What are the qualifications to buy an investment property?

To buy an investment property, you typically need a down payment of at least 20% and a good credit score. Lenders will also consider your debt-to-income ratio and the potential rental income of the property.

Can an investment property bring in income?

Yes, an investment property can bring in income through rental income or capital gains from selling the property.

Is buying a rental property a good investment?

Yes, buying a rental property can be a good investment as it provides a steady income stream and potential for long-term appreciation in value. However, it also requires careful research, management skills, and financial stability to ensure profitability.

Is buying an investment property a good idea?

Buying an investment property can be a good idea if you have the financial stability and long-term goals for it. It can provide passive income, potential tax benefits, and appreciation over time. However, it requires careful research and understanding of the real estate market before making a decision.

How do I choose the best investment property?

Consider the location, potential for rental income, and long-term value appreciation when choosing an investment property. Conduct thorough research and seek expert advice to make informed decisions.

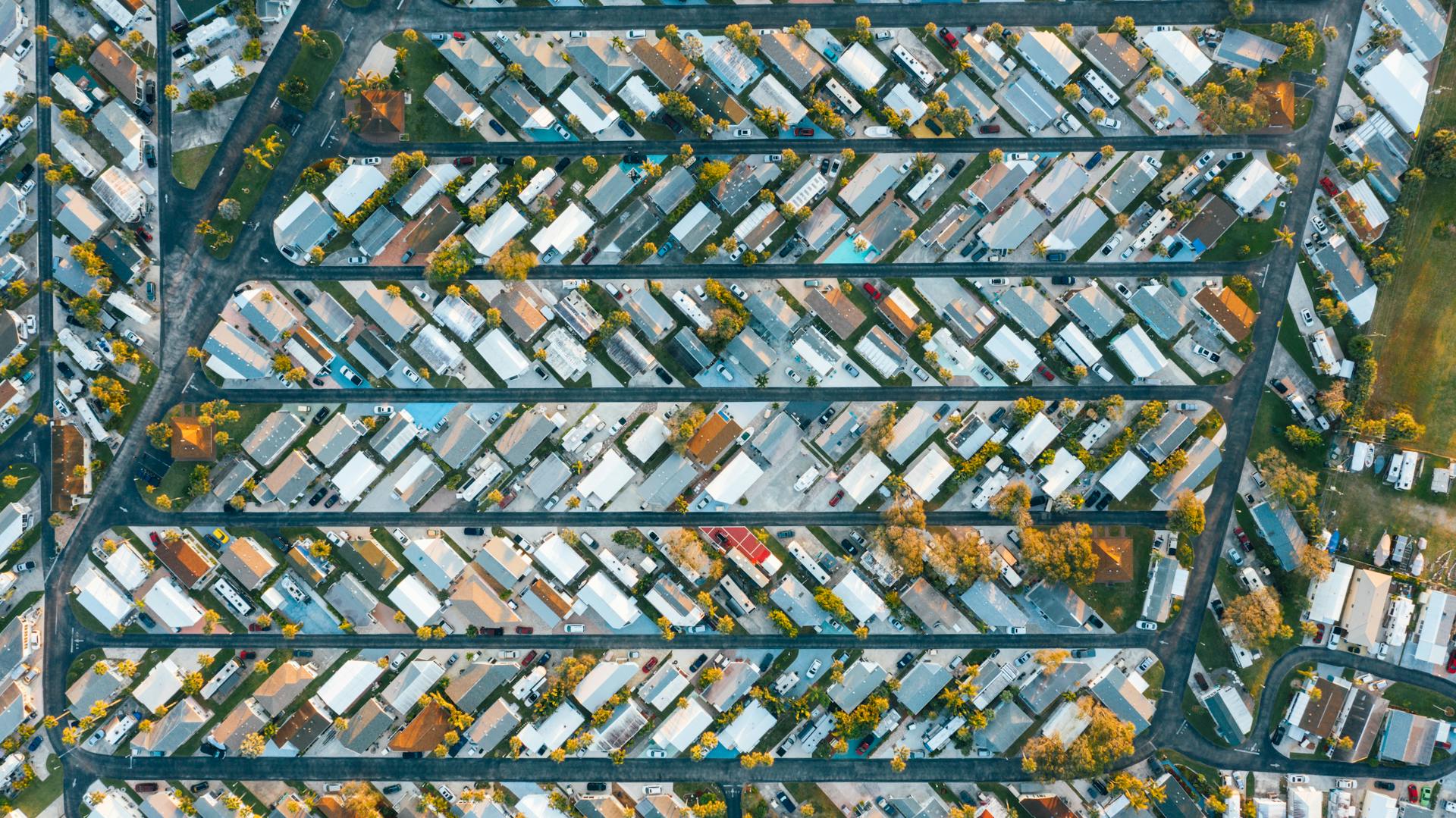

Featured Images: pexels.com