As a homeowner, understanding your property lines is of utmost importance. The lines begin where your property ends and your neighbor's property begins. This knowledge can save you from potential legal disputes with your neighbors in the future.

On February 22, 2023, new laws will be implemented regarding fences built on property lines. Being aware of the exact boundaries of your property can help you avoid any complications with these new regulations. In this article, we will dive into the secrets of property lines and help you unleash their full potential.

Before we proceed, we want to make it clear that this article contains affiliate links and follows our disclosure policy. We believe that educating homeowners about their properties is essential and we hope that our readers will benefit from the information provided in this article about understanding property lines. So let's get started!

Intriguing read: Property Manager

Discovering the Boundaries: Understanding Property Lines

Understanding property lines is crucial for homeowners and property owners. Boundary lines define where properties begin and end, giving homeowners a clear understanding of what they can and cannot do with their land.

Whether you're installing features like fences, pools, or home additions, knowing your property lines is essential. Physical markers such as stakes or flags are often used to indicate where your property line lies. The measured distance between these markers determines the exact location of your property boundaries, making potential improvements or major landscaping decisions easier to tackle with confidence.

Explore further: Investment Property

1. See What You Qualify For

If you're a first-time homebuyer or just curious about your property lines, it's important to find out what you qualify for before making any big decisions. By entering your home description and credit profile, you can quickly see your options for a home loan process online through services like Rocket Mortgage. Simply visit their sign-in page, enter your contact information, and watch the available options automatically pop up based on your qualifications - congratulations! Be sure to review their privacy policy and information regarding the Telephone Consumer Protection Act in case you need to resolve claims related to your inquiry.

Readers also liked: Home Equity Line of Credit

The Significance of Understanding Your Property Boundaries

A good understanding of your home's property lines is an important part of being a homeowner. Knowing exactly where your property begins and ends can prevent potential unpleasantries with neighbors, such as legal disputes or unknowingly encroaching on their privacy. Additionally, if there is an unknown property line encroachment or issue, it could result in a title company refusing insurance, making it difficult to sell the property in the future.

The Ultimate Guide to Locating Your Property Boundaries

Locating property lines can be an overwhelming task for any property owner. However, there are easy ways to find your property boundaries. Firstly, check your property deed which should contain a description of your land's boundaries. Secondly, look for markers such as metal stakes or fence lines that indicate the edge of your property. Lastly, hire a surveyor to accurately map out your property lines. By knowing where your property ends, you can avoid disputes with neighbors and ensure you have full control over your land.

1. Read The Property Line Map, Or ‘Plat’

To know exactly where your property ends and your neighbor's begins, you need to read the property line map or 'plat'. This map shows the property's boundary lines, elevations bodies, and shared property lines with neighboring properties. It typically includes details that are also found in a propertys paperwork and can be accessible online or at the local assessors office. So don't hesitate to find property maps that will help you better understand your property's boundaries.

2. Check The Deed To The Property

Are you unsure where your property lines lie? Before you start building that fence or planting those trees, check the propertys deed for the legal description of your lands boundaries. Make sure you have the current deed, as older deeds may include landmarks that no longer exist. Knowing your property lines is crucial to avoiding boundary disputes with neighbors down the road.

3. Acquire A Property Line Survey

If you're not sure where your property ends and your neighbor's begins, it's time to acquire a property line survey. This precise measurement of your land's legal boundaries is necessary for filing deeds, resolving disputes with neighbors, and understanding your property's history. A professional surveyor will also identify subdivisions, easements, ecological restrictions, and other factors that could affect your mortgage lender's decision to approve a loan. Don't wait until a boundary dispute arises – get a property line survey now.

4. Look For Property Line Markers

When purchasing a property, it's important to know where the property lines are to avoid any potential boundary disputes with neighbors. Newer properties often include property line markers, but slightly older properties may not have them. To ensure you have a clear understanding of your property lines, it's best to consult with top-rated pros today.

The Resurgence of HELOCs: A Trend That's Here to Stay

The resurgence of HELOCs is a trend that's here to stay, and it's got the mortgage nerds talking. Home equity has become a hot topic as tappable equity swelled to an all-time high of $6.5 trillion in 2019, thanks to rising home prices. Beast-mode homeowners are taking advantage of this trend by tapping into their home equity with HELOCs, which beats cash-out refinancing in many ways.

According to data analytics company Black Knight, HELOCs have been on the rise since 2014 when home prices flattened out. Interest rates for HELOCs are typically higher than those for a first mortgage but lower than those for cash-out refinances, making them an attractive option for homeowners who want access to their home equity without committing to a higher interest rate on their current mortgage or taking out an entirely new home loan.

With mortgage rates dropping by over 3 percentage points since last year, it's no wonder that HELOCs are back in the game. Cash-out refinances used to be the go-to option for homeowners looking to tap into their home equity, but with higher interest rates and stricter guidelines for approval, they're no longer the best choice for everyone. As long as interest rates remain low and home prices continue to rise, we can expect HELOCs to remain popular among homeowners looking for extra cash.

The Benefits of HELOCs: Why You Should Consider Using Them

HELOCs, or Home Equity Lines of Credit, are gaining strong motivation nowadays as a smart borrowing tool. Unlike subprime mortgages and subprime loans that were utilized before the 2008 financial crisis, HELOCs offer credit card-like flexibility with lower interest rates in comparison to a current home loan. By opening a credit line that allows you to borrow against your home equity, you can use it for home improvements allowing you to create the nicer home you've always wanted.

The rate lock-in effect is another benefit that comes with HELOCs. According to Marguerita Cheng, a Certified Financial Planner at Blue Ocean Global Wealth in Gaithersburg Maryland, people open HELOCs because they are looking for a rainy day fund or secondary emergency fund. Tim Melia, another Certified Financial Planner from Embolden Financial Planning, recommends drawing on your HELOC for emergency savings only when necessary but having it available in case of unforeseen circumstances.

Overall, the benefits of using a HELOC outweigh any potential risks if used responsibly. With low mortgage rates and strong motivation nowadays to make home improvements, opening a HELOC can provide access to funds when needed while also enhancing the value of your property. As long as you're aware of how much credit you have available and don't exceed your means, using a HELOC can be an excellent way to leverage the equity in your home.

Frequently Asked Questions

How to find property lines?

To find property lines, start by checking your property's deed or survey. If you don't have one, hire a surveyor or use a GPS app to determine the boundaries. It's important to know where your property ends and your neighbor's begins to avoid disputes.

How do I know where my land begins and ends?

To determine where your land begins and ends, you can check the official property survey or deed. You can also hire a licensed surveyor to conduct a new survey if there is any uncertainty.

What is a property line?

A property line is a legal boundary that separates one person's land from another. It determines the extent of ownership, rights and responsibilities of each landowner.

How do I know if my property has boundaries?

You can determine the boundaries of your property by reviewing your property deed, obtaining a survey, or consulting with a licensed land surveyor.

What are the benefits of having a property line?

Having a property line ensures that you have full control over your land, can maintain privacy and prevent encroachment from neighboring properties.

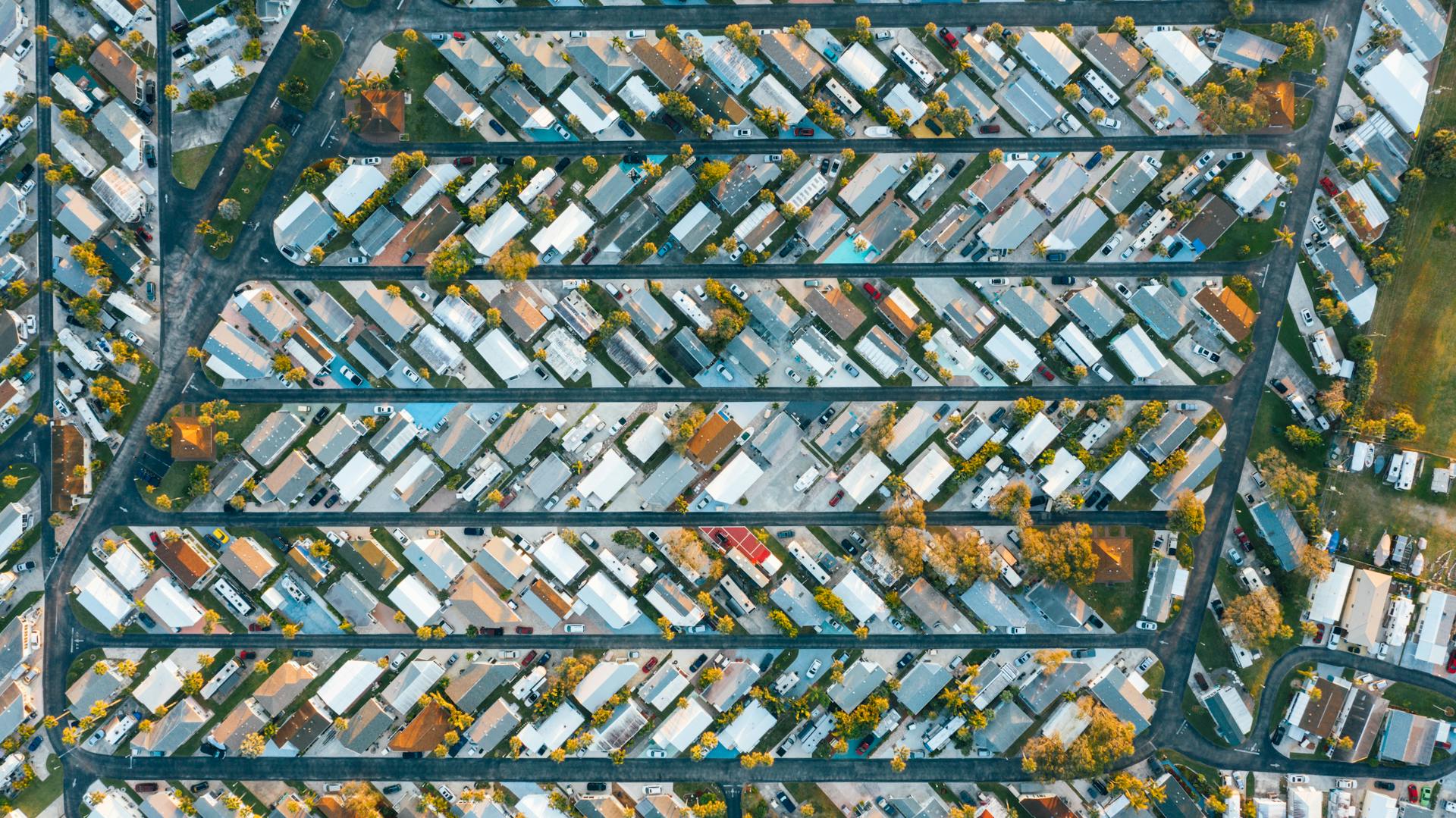

Featured Images: pexels.com